Selecting competent service providers is one of the most important fiduciary duties of a 401(k) plan sponsor – and it can appear daunting at first glance. Fortunately, this process can be made much simpler by understanding each service that makes up a 401(k) plan and applying appropriate benchmarks to those services to measure their value. Once you’ve done that, you’re ready to pick 401(k) providers based on the value of their services.

Commodity vs. Value-Added Services

Some 401(k) services are appropriately thought of as a commodity service – providers are competent and differentiation is based primarily (even exclusively) on price. Other services are “value-added” services, often tailored to the individual client. Providers are differentiated by the value received by the plan – and price is sometimes a minor consideration.

Here are the 401(k) services comprising a 401(k) plan:

- Custody – to hold plan assets in a trust and execute trades

- Recordkeeping – to track contributions, earnings and investments on a participant-level and direct the Custodian to execute trades

- Third-Party Administration (TPA) – to complete plan design, plan document, and annual ERISA compliance (testing, Form 5500)

- Investment Advice – to select an investment menu and/or make participant investment recommendations

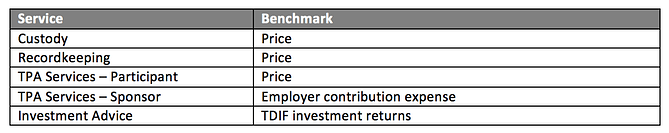

Custody and recordkeeping are “commodity” services. Like any commodity, given equal quality, the key benchmark for these services is price. The cheaper you can find competent custody and recordkeeping services, the better for participants. While execution speed and accuracy are also important, in my experience, speed doesn’t vary much provider-by provider and providers with accuracy issues are run out of the business by trade error reimbursements or lawsuits.

Investment Advice and TPA services are “value-added” services - the expertise of the service provider can significantly impact a plan’s value to participants (or the plan sponsor). That means it can be reasonable to pay more for these services if the marginal cost of a more expensive provider is outweighed by their value.

I recommend a simple two-step approach for evaluating the value of TPA services and investment advice. Choose a benchmark for each service – not the provider as a whole – and evaluate each service against a benchmark.

Third-Party Administration (TPA) Services

I think it’s best to consider the value of TPA services for participants and plan sponsors separately.

When you add custody, recordkeeping and TPA services together, you have a platform, or conduit, for 401(k) investing. To maximize participant investment returns, I think this conduit should be as efficient as possible cost-wise. For this reason, I would use price as the benchmark for evaluating the value of a TPA to your participants.

401(k) plans are generally established with specific contribution goals in mind (maximize owner’s share of total contributions, match employee 401(k) contributions to incentivize participation, etc.). A well-designed 401(k) plan meets these objectives at the lowest cost, sometimes saving an employer tens of thousands of dollars in the process. For this reason, I would use employer contribution expense as the benchmark for evaluating the value of a TPA to your business.

Investment Advice

Investment advice may seem like the most daunting service to benchmark, but I don’t think it needs to be. For purposes of benchmarking, I will define investment advice as both investment menu selection and participant-level investment advice. Participant investment returns are a function of the investment advice they receive.

The use of index funds and Target Date Funds (TDFs) in retirement plans has grown dramatically over the past ten years. Index funds offer inherently-diversified market returns at a low cost, while TDFs offer a professionally-managed mix of funds that grows increasingly conservative the closer a participant gets to retirement. A Target Date Index Fund (TDIF) is a TDF that uses a mix of index funds.

I consider TDIF returns to be the benchmark for 401(k) investment advice. I’m not saying a financial advisor can’t deliver investment returns for participants in excess of TDIF returns (after all expenses are considered) – I’m saying they should never do worse. Period.

We wrote about this concept last year in a blog titled Low-cost target date index funds will fundamentally reshape the market for small business retirement plans – and soon!

Summary

Don’t Shop by Check Box

Over the years, I have seen a lot of sponsors shop for 401(k) service providers by checkbox. In other words, they pick providers based on the breadth of the services they offer. What’s the value of a feature no one uses? None in my book. That’s why I don’t advocate this approach - there needs to be a correlation between expense and value.

First and foremost, it should be the goal of every 401(k) plan to facilitate retirement security for its participants. Expert service providers can help a 401(k) plan meet that objective, but costs need to be matched to value added to the plan.