I look at a lot of 401(k) service provider fee (408b-2) disclosures. At least 2 per week. Some are excellent and straight forward, while others are as clear as mud. This is a problem for 401(k) fiduciaries. It’s their responsibility to ensure their 401(k) plan only pays reasonable plan expenses. When 408b-2 disclosures are unclear, satisfying this responsibility becomes more difficult.

Great-West Financial (G-W) is one of the nation’s largest 401(k) service providers. As such, I see their 408b-2 disclosures regularly. I don’t find them particularly intuitive, with all fees easily discernable. That is why I find it ironic when G-W includes the tagline “Clarity in a Complex World” on page 1 of their 408b-2 disclosures.

I thought I would put the G-W tagline to the test. Last week, we received a G-W 408b-2 disclosure for a $1,718,947 plan with 5 participants. Judge for yourself. Does it live up to its “Clarity in a Complex World” billing? I will share some of my thoughts.

100% of fees paid through revenue sharing

Sections A-C of the disclosure summarize the fees detailed later in the report. These sections also explain services for which these fees apply. For the plan in question, 100% of G-W fees are paid by revenue sharing (shareholder-servicing fees, sub-transfer agency fees, distribution or 12b-1 fees, and other account recordkeeping fees).

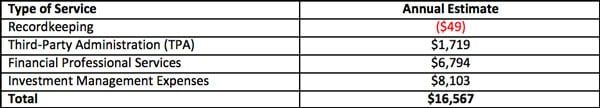

According to Sections A-C, the following expenses apply to the plan:

The plan pays $8,464 per year to G-W (and an independent TPA) for plan services, while fund investment expenses are $8,103. I found the -$49 recordkeeping fee interesting. As a recordkeeper myself, I know recordkeeping services are never “free.” There is always a cost in delivering these services that must be covered. Currently, 78% of plan assets invested in proprietary G-W funds. Is proprietary fund revenue subsidizing recordkeeping fees? I can’t be certain.

Some compensation not disclosed

The plan offers a proprietary “General Account Fund” that guarantees a 1.2% return to investors. Often, the greatest expense of a guaranteed account like the General Account Fund is its “spread.” The “spread” is the difference between the guaranteed interest rate vs. the actual earnings of the fund’s underlying investments. As the issuer, G-W would keep any spread – compensation in my book – earned by the General Account Fund. Service providers are not required to estimate a spread in their 408b-2 disclosure.

This omission could be a problem for 401(k) fiduciaries. In Gordon v. Mass Mutual Life Ins. Co., a 401k participant sued their plan sponsor in part because the guaranteed account’s spread was not disclosed.

It’s not easy to be a 401(k) fiduciary

“Clarity in a Complex World” is a pretty bold tagline - and in my opinion - the G-W 408b-2 disclosure doesn’t live up to it. It’s not clear to me why recordkeeping services are “free” or if all guaranteed account expenses are disclosed. I also think the amount of compensation received by any of the 9 G-W affiliates mentioned in the Affiliates and Subcontractors section should be disclosed. That information could be used to evaluate the likelihood of conflicted investment advice.

Bottom line, I think the G-W 408b-2 disclosure generates more questions than it answers. And that’s a problem for fiduciaries who need a clear accounting of 401k fees.